Latest update 02/2024

Since the UK parted company with the EU, it is becomming harder to source low, or tax free silver coinage directly from European wholesale trade, or certainly without the added import duties and vat. This really leaves the secondary market, as the best source for silver bullion coinage, trading directly from private retail or small businesses.

All information contained herein is editorial, experience and opinions, it should not be ascertained as personal investment advice. Our primary business is assisting private and trade purchases of sales of silver coins and bullion here in the UK. Since we are not affiliated to any one commercial organisation, nor do we sell trade quantities of silver ourselves, we are free to report on and assist you with all aspects of the silver trade.

- If you want to skip most of the silver buying article! : the simplest way to find the best price vale on silver coinage is simply to deal with smaller businesses and trusted private coin sellers, which is exactly what we do on the SilverHubs!

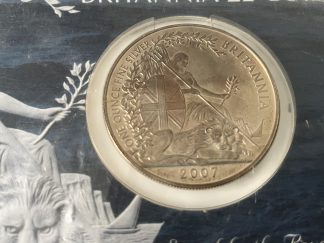

Britannia 1 ounce 999 silver bullion coins Physical coins which you own in your possession. Britannia £2 silver coins are legal tender in the UK and is therefore Capital Gains Tax Free, CGT Exempt. The UK Mint Britannia coins contain one Troy ounce of fine 999 silver bullion.

An important cautionary note regarding VAT free silver coins for storage outside of the UK: Personally, I would be cautious of the value and investment potential offered by bullion dealers who are providing ‘vat free silver coins and bars for overseas storage‘ or ‘reduced premium silver coin prices’ for allocated overseas storage. This form of holding silver means that you do not physically have possession of the silver bullion coins yourself. Hence when you want to re-sell the silver coins you are:

A/ restricted who you can re-sell the silver to, meaning you’ll probably only get close to spot price, loosing most if not all of any premium you’ve paid for coins.

B/ If you want to actually take physical delivery of the silver bullion coins so that you can re-sell on the open market, you may then incur the additional import duties plus the 20% VAT, if you want to take actual delivery and ownership in the UK, plus shipping costs! see notes below for more information.

Silver stacking context: As a fellow silver bug and silverstacker I have compiled useful information learned from my own experiences collecting silver bullion coins and bars since 2009 when I purchased my first significant batch of Sterling 925 silver bullion coins. More silver stacking followed in 2011, although with silver doubling in price from around £10 per ounce to over £21 per ounce, I was then paying around £29 per ounce for the China Mints 3-999’s silver Panda coins to join my existing collections of older pre-1920’s .925 Sterling silver.

At $1500 gold – a relatively modest 70/1 ratio makes silver valued at over $21 per ounce.

With silver mined and found naturally in the ground at a ratio of 11/1 – I believe we will once again eventually see physical silver bullion trade over its $50 previous

With the growing popularity of the newer .999 pure silver bullion coins It can appear a complex market when it comes to sourcing these silver bullion coins in GB at a fair price in relation to the silver spot price and that’s before UK dealers add in their selling margins and the VAT! Buying silver bullion coins from dealers with secondary market lower taxed silver, dealers in lower tax jurisdiction locations or even better directly from fellow private silver investors who are looking to sell directly is usually the best way to find the lowest costs per ounce.

Buying silver bullion coins at best vat free per ounce prices

Tip No.1 – keep it simple, trade direct, deal with trusted sellers with reliable reputations supplying fair priced silver bullion coins. Silver is a natural element symbol Ag. which has performed a perfect role as a natural, reliable, trusted form of money for over 4000 years, enabling people to conduct trade directly between buyer and seller, person to person. Aim to eliminate as much of the supply chain and complexity from buying your silver coins as possible and you’ll discover how to lower your overall silver costs per ounce.

Tip 2. Silver Premiums always disappear with time, in the long run most value investors tend to price silver in relation to the spot market bullion price plus a reasonable coinage premium. Unless the coins are really scarce and sought after, the lower the initial premium bullion you pay, the higher your gain on resale. As a general rule you will make more money on silver bullion from buying coins as close to ‘bullion spot’ as possible, than simply hoping that a huge rally in silver prices will help you recover higher priced, taxed premium coins.

Silverhubs VAT trade direct coin sales facility

As we develop CoinsUK SilverHubs further, there’s lots of silver knowledge and trading tips that I’m alway happy to share and help fellow UK coin buyers with, as more than ever in 2023 the silver bullion market has huge choice and price variations. The good news is that it really doesn’t need to be complicated, keep things simple, gather and share trusted information, experience and sales facilities – all things I’m working hard to share whilst I work with both the silver industry and retail to improve silver’s appreciation and hopefully a steady return to more awareness for silvers true role as the ultimate global ‘sound money’ and store of value.

UK Mint Britannia £2 pure .999 silver bullion coins

COINSUK offer you a fast assured low cost source for your UK silver bullion coins. We have bulk silver bullion available for fully insured, free next day delivery. Assured quality checked and official Mint distributor sourced silver bullion coins. All pure .9999 silver coins are in high demand. SilverHubs can offer the best UK prices, significantly better than silver spot on all bullion coins, including 9999 silver Mapleleafs, 999 silver Krugerrands, Perth Mint Dragon bars, 999 silver UK Britannia, as well as all other official world Mint bullion coins.

Taking delivery of physical silver bullion saves storage costs & counter-party liabilities

There’s a saying in precious metals forums – “If you don’t hold it – you don’t own it!”

Whilst the lure of VAT free offshore stored silver coins and bars sounds appealing, it usually comes with a couple of significant catches; 1. There’s a monthly storage fee & 2. If you ever want to physically get hold of your silver in times of financial turmoil, they’ll be extra shipping costs as well as any relevant vat and taxes to pay once you opt to take delivery. Most ‘allocated platforms’ also have fees or a buy/sell spread.

The simplest, safest way to buy and hold silver bullion is to buy popular internationally recognised Minted coins which are easy to re-sell, small units of easily tradable silver like Britannia, Krugerrands, Dragon bars etc. Buy from a non registered or VAT free seller and take physical ownership at the lowest cost per silver ounce you can secure.

Secondary market and trade business vat silver prices

Silver price observations; Silver had been caught up in the general ‘sell everything’ markets! Having tested around the $18 level which is close to the cost of raw silver production for many of the silver miners. Subsequently returning to the $19-$20 regions, which is still on the low side, given the current gold to silver ratio, amongst other assets.

Premiums rose Worldwide (including Britain) which negated much of the fall in ‘paper silver’ markets. Good quality, well priced, silver bullion coinage remains in steady demand, especially on the secondary vat free market from privatesellers, or the smaller trade businesses, such as ourselves.

2014 experienced good silver bullion demand and historically low spot prices with further purchases of VAT free silver; the limited issue horse privy editions £2 bullion Britannia which the UK Mint initially released to the VAT free USA and European wholesale bullion trade and wholesale coin markets.

In 2011 with silver at £21 / $27 per ounce – there was strong interest and growing demand for real physical silver bullion. What followed was almost constant short selling of paper derivatives and paper futures contracts on the comex market which constantly drove the spot silver price back towards the £10-£13 ($13-$16) levels, ultimately creating another unique opportunity to accumulate physical silver at historically attractive prices.

The silver market has evolved a lot over the last 10 years with plenty of new releases joining the pure 999 silver scene! I’ve got some exciting projects underway to help fellow silver-stackers gather accurate up to date information as well as share my insights into buying silver at the best possible prices whilst always keeping a fine eye on what to buy and just as importantly how and where and to re-sell your silver coin investments without loosing a good proportion of your investment to taxes, commissions and selling fees!